Quickbooks Desktop

Fast-Weigh Integration with Quickbooks Desktop

Fast-Weigh indirectly integrates with Quickbooks Desktop (QBD) primarily through the use of a 3rd party tool called Transaction Pro Importer (TPI). Fast-Weigh can export a customizable CSV containing billing data that can be imported into QBD as an invoice with TPI.

First Time Setup

Setting up Fast-Weigh Resources

Customers: The Customer Name in Fast-Weigh will need to match the Customer Name in Quickbooks Desktop. Customer ID will only be referenced in Fast-Weigh.

Products: The Product ID in Fast-Weigh will need to match the Item name in Quickbooks Desktop. The Product will only be referenced in Fast-Weigh.

Tax Codes: The Tax Code Name will need ot match the Sales Tax Item name in Quickbooks Desktop. The Tax Code will only be referenced in Fast-Weigh.

Invoice Numbers: Quickbooks does not allow for duplicate invoice numbers (Ref Number), to avoid unwanted errors it is best to enable an invoice number prefix in Fast-Weigh

Navigate to Admin Settings (gear icon) > Portal Settings

Enter a prefix in the Optional Invoice Prefix field

we recommend using "FW"

Exporting Fast-Weigh Billing Data

After batching tickets onto invoices you will be able to export the data via CSV.

Navigate to Billing/AR > Billing

Switch to the Billing History tab

Click Export on the batch you would like to export

Installing Transaction Pro Importer

Once you have purchased a license from Transaction Pro you will need to install it on your computer

Upon initial installation of Transaction Pro, the software must be connected to the QuickBooks company file that you wish to use it for.

If Transaction Pro will be used with multiple QBDT company files, then this process will need to be repeated for each company file for the initial connection to each.

Note: Once the initial connection has been completed, users of Transaction Pro are not required to have Administrative rights. However, Transaction Pro users must have read/write access to the Chart of Accounts in QB as well as to any section in QBDT into which the user will be importing or any section out of which the user will be exporting.

Installation

Before launching Transaction Pro (Importer, Exporter, or Deleter) for the first time, open the QBDT company file to which the Transaction Pro product is to be connected.

For the initial connection, the user must be signed in as the ADMIN user and be in Single User Mode.

Only one QBDT company file can be open at a time when using Transaction Pro.

Wait for QBDT to completely open before launching Transaction Pro. Once QBDT is completely open, launch the Transaction Pro product.

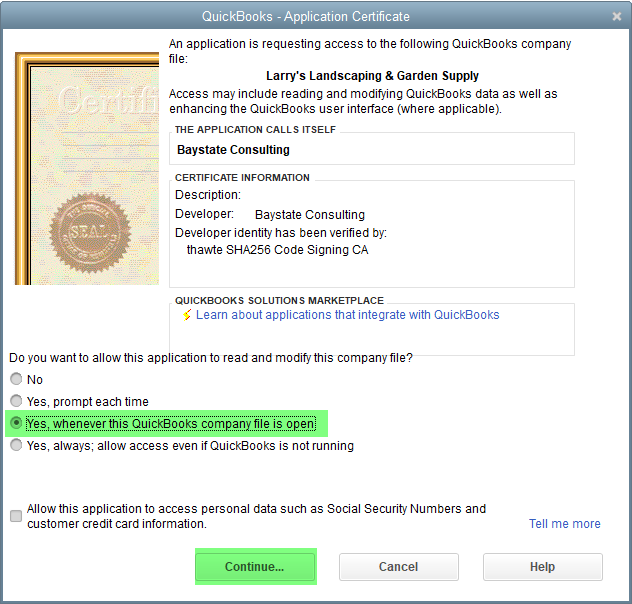

An Application Certificate will appear to verify the connection between Transaction Pro and QBDT. It is suggested to select the third option YES, WHENEVER THIS QUICKBOOKS COMPANY FILE IS OPEN.

Also, if personal data such as Social Security Numbers or credit card information will be imported or exported, select the option at the bottom to allow Transaction Pro access to this information. (This option may be updated at a later time, if necessary).

NOTE: If the import or export will be automated, the fourth option should be selected - YES, ALWAYS; ALLOW ACCESS EVEN IF QUICKBOOKS IS NOT RUNNING.

Click CONTINUE.

The next window allows you to confirm Transaction Pro's access to the QB company file.

Click DONE.

Configuring Transaction Pro Importer

Launch Transaction Pro

Select Importer

Confirm the following settings:

Select you file source: file

Select a field delmiter and new record character:

Field: Comma

Record: CR/LF

Import Type: Invoice

Click Options:

Basic Options

Optional List Items: (click the check box for anything you do not want TPI to Add/Update)

Do not update addresses on existing Quickbooks List Items

Do not add new customers to Quickbooks

Do not add new vendors to Quickbooks

Do not add new items to Quickbooks

Do not add new accounts to Quickbooks

Import Options:

If you are receiving errors during import it is possible that some records being imported from Fast-Weigh exceed QBD's maximum character length. Enabling "Truncate import field data that exceeds maximum length allowed by Quickbooks" can prevent those errors

Advanced Options

If you have custom item fields (CIFs) enable "Enable Custom Fields defined in QuickBooks company file"

NOTE: a common use for a CIF is Ticket Number

Mapping Transaction Pro to Fast-Weigh Export

General Mapping:

Customer

Customer Name

Transaction Date

Invoice Date

RefNumber

Invoice Number

PO Number

PO Number

Item

Product ID

Quantity

Net Units

Description

QB Description

Price

Unit Rate

Sales Tax Item

Tax Description

Sales Tax Code

Taxable (N or Y)

If you have a custom export these field names and mappings may vary. If you need assistance with installation or mapping you can reach out to our Support by calling 865-219-2980 or emailing [email protected]

Last updated